Last week, The Lola hosted an amazing event with over 75 women (not including the waitlist)!

What did these Atlanta women want to talk about???

Money, of course! 🤑💰💪

Led by the brilliant finance guru, Meredith Moore, with over two decades of financial planning experience, we talked about:

Monthly Money Meetings

2023 Financial Planning Checklist

Research on couples and money dynamics

Commonly asked money questions

If you couldn’t make it, love finances, or are wondering what gets talked about at a womxn’s community and co-working space, here’s the recap!

Meredith’s Awesome Ted Talk

➡️ Start here: The Right Way For Couples To Talk About Money

5 Things To Consider When Talking To Your Partner About Money:

Contribution - including non-monetary items

Transparency - be honest and avoid judgement

Values - what matters to you and why

Equality - partner with greater income, education, or age often holds the power

Vision - identify long-term vision and work backwards

“The most important thing we can do is normalize the conversation around money.”

#1 Recommendation

**Schedule a Monthly Money Meeting.**

Put it on the calendar.

Invitees

You + your partner

You + pet/accountabil-a-buddy

You

[OPTIONAL] Bring wine. 😁

What To Cover:

Update (or create) your balance sheet

Review (or start tracking) expenses

Discuss contribution, transparency, values, equality, vision

Work through your 2023 Financial Checklist ⬇️

“Engagement is more important than knowledge.”

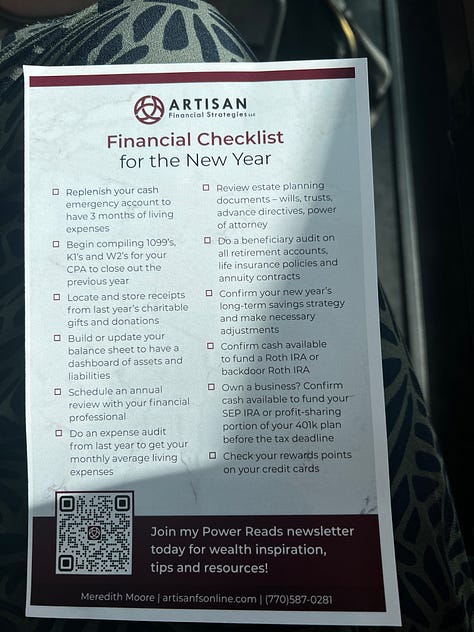

2023 Financial Checklist

Replenish emergency fund

3 months personal living expenses

Separate from business liquidity/expenses

12 months for senior leaders ➡️ takes longer to find new role

Compile 1099, K1, W2s

Locate receipts from charitable donations

Update (or build) your balance sheet

Financial dashboard

Include accounts, debts, real estate, investments

Annual review with financial professional

Expense audit from last year

Know your monthly living expenses

Range from $4k/mo to $30k/mo

It’s a data point, no judgement!

Review (or create) estate planning documents

Use a lawyer. NOT online doc.

One-time flat fee

Beneficiary audit on retirement accounts, life insurance, annuities

Confirm long-term savings strategy

Most people underfund “mid-term savings”

Don’t have everything in retirement and your house

Fund Roth IRA or Backdoor Roth IRA?

Business owners ➡️ SepIRA, profit sharing for 401k?

Check rewards points on credit cards

“Get in the trenches and start looking at your own financials.”

Research Shows…

Partner with greater income, education, or age more likely to hold financial power

When women are breadwinners, larger % of discretionary $ towards housework and kids

Whoever does more housework = less financial power

Women + Money

You don’t have to know it all to get started!

Money is a shared responsibility.

Whether you are a breadwinner or primary caretaker, MBA or no college education, you are capable and deserving of financial empowerment.

Many women come to Meredith after being widowed or divorced who had little to no involvement with finances. It’s harder this way.

It’s never too late to start learning and getting involved. (See “Monthly Money Meeting” above.)

Best first task? Put together a balance sheet.

“Understanding money gives you options.”

Word of the Day: Retirement Work Optional

Paradigm is shifting. Pure retirement is rare.

Know your average monthly expenses for realistic picture

Entrepreneurs planning an exit ➡️ what is your “work optional” amount?

Create other streams of revenue

More execs shift to board positions, consulting, or coaching than retirement

Q&A: What should I do about my parents’ finances?

Set up a meeting to discuss

Use a facilitator if needed

Topics

Retirement accounts/pensions

Long term care insurance

Estate planning

Balance sheet (accounts, debts, financial items)

Q&A: How do I combine finances with my partner?

Set up a Monthly Money Meeting

Avoid judgement

Discuss: Contribution, Transparency, Values, Equality, Vision

Set out tasks and agenda items

Q&A: What’s the biggest mistake business owners make?

Not enough liquidity

Everything is tied up in the business or real estate

Take those golden eggs and put it in other assets

Thank you, friends!

Thank you, Meredith, for the amazing content and sharing your wisdom.

Thank you, Eileen Lee, founder of the Lola, who brought us together and hosted.

Thank you, Sweetgreen, for sponsoring the delicious salads. (See? It IS possible to eat healthy while building! 😉)

Thank you, Monica Hooks, Suna Lumeh, Margaret Weniger, Anastasia Simon, Kristin Slink, Tammy Napier, and Jacey Cadet for moderating small group discussion!

It was an honor and a joy to work with amazing women to provide value for amazing women.

Let’s keep this money conversation going!

What is the best financial advice you’ve gotten? Any 2023 financial checklist items to add?