Real Life Pricing Strategy: A Pardot Case Study

Pricing Evolution in the Wild

Last week, we talked about the 4 key components of your startup pricing strategy.

This week, we’ll see what pricing strategy looks like in a real startup.

Here is the real life pricing evolution of Pardot — as told by the pricing page archives — a B2B Saas company with explosive growth that is now part of Salesforce.

I joined as employee #9 and launched and lead the Customer Success Management team. As CSMs, we were on the front lines of pricing, handling customer upgrades, renewals, and attrition.

Join me for a trip down pricing memory lane with strategy, pros and cons, and the behind-the-scenes details.

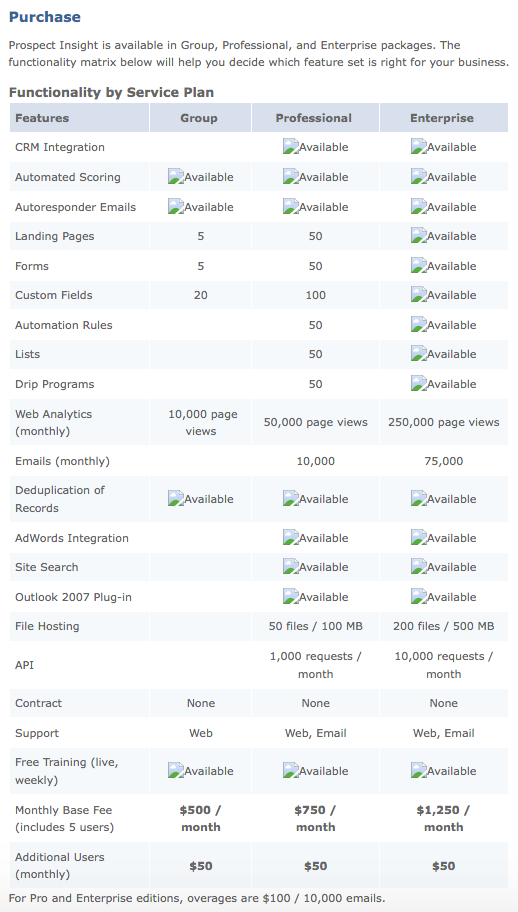

February 2009

Setting the Stage:

We’re at 80 customers, 3 pricing tiers, and customers upgrade when they need more users.

“Available” broken image = ✅

See full February 2009 pricing page here.

What’s Working:

Good, better, best pricing tiers.

95% of customers sign up for Professional or Enterprise. The limitations of the Group tier (no email or CRM connectors) naturally move buyers towards Professional while still offering an entry level for budget-conscious customers.

Simplicity.

Put it on a credit card, no annual contract.

Month-to-month contracts help sell early customers before you have a track record.

“We win your business every month” and “Low risk to try us out” are common sales talking points.

Our target customers understand user-based pricing because of software tools like Salesforce and Netsuite.

What’s Not Working:

User based pricing = customers are incentivized to not add others users to keep costs down.

This hurts overall adoption.

Ideally pricing aligns with customer value and encourages deeper usage. We fix this soon. 😉

Limits on components like forms, landing pages, and analytics result in small upgrade requests (for those items only) which are hard to track and not much revenue.

Pricing v.1 works (among many other things like authentic demand and product market fit)! Pardot is growing quickly. Which leads us to Pricing v2…

March 2010

Setting the Stage:

We have a couple hundred customers now. We’re pricing primarily off of email usage (users are unlimited). The market is heating up. We’ve raised prices and offer an annual prepay discount in addition to monthly pricing.

“Available” broken image = ✅

See full March 2010 pricing page here.

What’s Working:

Email as a pricing lever aligns much better with customer value.

Unlimited users = encourages adding sales users, more marketing users, and giving execs access to reporting. Product “stickiness” improves.

Get 30k emails for $1000/mo or get 3x more emails for only 50% more in dollars ($1500/mo) → value-based pressure to move to Enterprise.

Pricing Strategy 101.

It works.

What’s Not Working:

Email sending and contact storage (# of emails in customer’s database) are the two most expensive technical costs. If a customer has a small database but sends a TON of emails, we could lose money.

Only “feature” differentiator between Professional and Enterprise is the amount of stuff you get. There’s no advanced product functionality at Enterprise to encourage customers to upgrade.

Meanwhile, competitors are starting to charge on database size…

March 2013

Setting the Stage:

Pardot has been acquired by Exact Target! (Nine months later Exact Target will be acquired by Salesforce.) The customer count is around 4 digits. Selling into enterprise accounts has begun. Pricing scales to capture value (and budget) of larger accounts. It increased to match the current market rates and the product advancement. Way more product feature offerings than v.1!

And as predicted, we now price on database size instead of emails.

See full March 2013 pricing page here.

What’s Working:

Database pricing.

Pardot followed this market trend and updated accordingly.

Pricing is more closely aligned with customer value. A customer’s marketing improves because of Pardot → more leads → Pardot account grows.

Annual contracts.

These are the norm now. Paid annually or quarterly.

Maturity and social proof in the market make annual contracts easy.

Many buyers are repeat users, marketing automation consultants are a thing (and recommend us), and we have lots of customer case studies, references, and reviews.

Bye bye, Group tier.

Still 3 tiers but the Group juice was not worth the squeeze.

The “Ultimate” tier was added as Pardot moved upmarket.

What’s Not Working:

Differentiation between tiers.

The difference between pricing tiers is still primarily usage-based (e.g. 50 landing pages → unlimited landing pages).

Ideally there are functionality-based reasons to upgrade also (e.g. get advanced email features in Ultimate only).

Where Is Pardot Pricing Today?

When Pardot was acquired by Salesforce, we worked with some of the top SaaS software pricing strategists in the world to further iterate on the pricing tiers and offering.

Stay tuned for the next installment of The O’Daily where we dive into the ultra-advanced, Navy Seal-esque learnings of pricing strategy at a F500 level!

Any great startup pricing case studies to share? Any fun screen grabs or stories from the pricing “early days” of a company’s history?