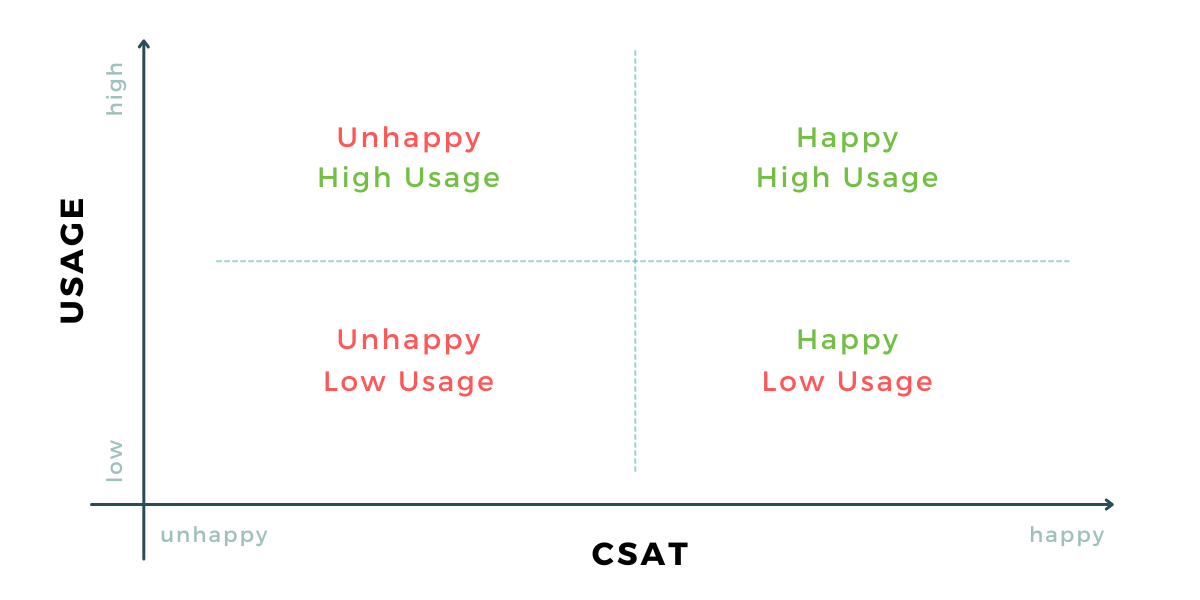

What’s more important — how your customer feels about you or what their usage tells you?

It’s an age old question in customer experience.

Here’s how I think about it:

Axis #1 = customer satisfaction (CSAT) - reported via survey

Axis #2 = customer usage - reported from within the product

Which creates 4 quadrants:

High CSAT, High Usage

High CSAT, Low Usage

Low CSAT, High Usage

Low CSAT, Low Usage

You can then prioritize and personalize the outreach to each group.

Below, we break down the likely reasons for each type of score, the most effective action steps, and the risks for each bucket.

Understanding each situation will help you maximize time, impact, and results of customer success efforts!

4 Quadrants of Customer Usage & Happiness

1. High CSAT, High Usage

**power users who love you**

These are your reference customers and Customer Advisory Board members.

They are the template for sales and marketing to identify the “Ideal Customer Profile.”

More of these please!

The Play:

Show lots of gratitude and love — holiday gifts, thank you notes, sharing sneak previews, extra access to the team.

Get them to be case studies (or Customer Win Slides) if they’re not already. Feature your power user and their brand as a way to say thank you.

Great customer discovery resource for your product team.

They won’t need you often, but if there’s a support issue or feature request, it’s a good time to give them red carpet treatment.

Risk Assessment:

Biggest risk = power user change or turnover. Proactively reach out to new users to get them up to speed.

Second biggest risk = don’t burn them out or take them for granted! :)

2. High CSAT, Low Usage

**Happy under-users**

They use one feature.

They’d be better off with a different tool.

You know they’re at risk but they keep telling you they’re fine!

The Play:

What’s the *ONE* additional feature that is mostly likely to be helpful? Don’t overwhelm! Their usage is low for a reason — they either don’t have the time or expertise to do more.

Be VERY proactive. Including helping to build, implement, train, or set up more for them.

Is there someone else at the company who might be a user? Or use a different part of the app?

Power user change? Great opportunity to increase adoption!

Risk Assessment:

Watch out when:

Budget gets tight

New boss comes in

Low-end competitor reaches out to them

These are at-risk customers but, after an initial effort, unless there’s an internal change, your time is usually better spent elsewhere. It’s hard to fix it when they don’t think it’s broken!

3. Low CSAT, High Usage

**cry for help or too enterprise**

They’re not happy but usage is high.

Usually because they are stretching your tool to the limits.

They need enterprise features like advanced permission settings or multi-tenant management.

Or maybe they’re using your product in a hack-y way (e.g. a B2B tool for B2C company).

Or — best case — this is a cry for help. Remember, angry customers are a good sign!

They care enough to get frustrated and tell you about it.

I’ve seen low scores from:

an unresolved bug

a confused first-time user who’s inheriting someone else’s set up

a feature gap that’s getting resolved soon

The Play:

Assess why they’re unhappy and if you want to serve this type of customer long term. Good fit? Do everything you can to save them! Bad fit? Help but don’t spend extra time.

Assuming this is a good-fit customer:

Understand their key complaints and make an action plan!

Assign *one* person who is their point of contact if they need extra attention. Don’t bounce them around to different teams.

New user? Provide extra training and a walk-through of their account.

Feature or bug issues? Keep them up to date on bugs, support tickets, and/or product roadmap.

Involve them in feedback sessions or on your customer advisory board.

Work on creative just-for-now solutions including helping them with manual work arounds.

The idea is to keep them with you until you can solve their problem. (Or be honest if it’s not the right long term fit!)

Make sure you understand their North Star metric and see if you can’t generate a Customer Win while you’re working on other items for them.

Risk Assessment:

Some users will be unhappy but stay with you!

They can’t afford a different tool.

You’re the best of bad options.

They don’t think any tool ever is good.

If they really suck — unkind to your team, angry, unreasonable, taking up a bunch of time — you should fire them. More on this in a future post!

Listen carefully. If they’re asking for specific features that a competitor offers, they are looking at other tools. Pull out the stops to save them!

4. Low CSAT, Low Usage

**Very at-risk**

They’re not using and not getting value. Makes sense that their satisfaction is in the dumps.

But they did buy your product initially so someone somewhere thought it would be helpful.

Time to dig in!

The Play:

The big question is — why is usage so low?

Over-sold, we can’t do what they want, not a fit

Small team, no time to implement

Implementation too complex or technical blocker

Change in power user immediately after purchase

Waiting on an internal initiative to get started

Something else!

If this customer is a good fit, release the kraken! Kraken being your best customer success strategies:

a dedicated account manager

escalating to the “Red Account Team”

complimentary re-implementation

engaging sales to help “re-sell” them

setting up calls with your CEO to really show them the love

As your Kraken works, make sure you understand your customer’s North Star metric and align to this!

Risk Assessment:

Is the juice worth the squeeze? It will take a lot of time to increase usage and make this customer happy. Make sure it’s worth it from a revenue and resources perspective.

Is the customer bought in and willing to put in the time as well? You need a committed internal owner or power user to make it work.

In the wise words of a hilarious, long-time customer success manager:

You can bring a customer to water but you can’t make them drink.

And when they die of dehydration, they’ll blame you!

😂😂😂

Nothing like some snarky customer humor to remind you that — customer success is a two-way street. Even the best Customer Success Manager can’t save an unwilling customer.

Where Do You Start?

In a perfect world, you attack all quadrants at the same time.

But startups do not have unlimited resources (what does, really?) so we must prioritize!

Obviously, use your best judgment based on your unique company, customers, data, and situation.

And there’s a huge caveat to — LOOK AT CUSTOMER CONTRACT AMOUNT!!! This framework assumes that customers are paying about the same or that you’re segmenting first based on customer spend.

So assuming you’re accounting for different customer spend…

Here are some general recommendations to get you started:

High CSAT/High Usage customers are the most valuable to your business. Least amount of effort, most likely to refer new business or expand, great renewal rate. They won’t take much time but are most important. If you don’t have these, you don’t have a company. Prioritize here!

All things being equal, Low CSAT/High Usage customers are the most likely to convert to happy customers. They don’t want to leave. And they may have valuable insights or learnings for your team.

Low CSAT/Low Usage customers MIGHT be worth trying to save. They must be an ideal fit, have willingness on their side, and be paying enough to make it worth it!

In my experience, High CSAT/Low Usage customers are hardest to influence or shift. It’s a pain point for you but not for them. There’s no incentive on their end to reply to emails, hop on a call, or do more work in the tool.

While your happy, high-usage customers are the priority, it’s realistic to spend 80% of time on unhappy-but-there’s-potential customers, and 20% of time on keeping your best customers happy.

What do you think is more important — customer usage data or self-reported customer satisfaction data?

What strategies are most effective? Any surprising results or effective tactics with different types of customers?

COMING SOON: Which should you start tracking first — usage metrics or customer satisfaction???

I found your post to be incredibly insightful and valuable. The playbook provided a wealth of helpful insights that I thoroughly appreciated. I do find both CSAT/NPS and usage/engagement metrics to be quite informative, though I've come to understand that neither stands as the sole determinant.

I've learned that the effectiveness of playbooks varies widely based on the solution they're applied to. For instance, in a Wellness solution, 'usage' holds significantly more significance compared to an 'observability' solution. In observability, the mere use of a platform doesn't generate ROI; rather, it's about taking action on that information to derive actual value. On the other hand, in Wellness solutions, the usage itself holds inherent value.

In my view, the primary focus should revolve around two critical aspects:

1. Realizing tangible value (identifying, measuring, documenting, and celebrating positive business outcomes)

2. Progressing through a sequence of milestones, from simpler to more complex, creating a sort of Journey Map. This approach ensures that the value isn't merely anecdotal.

However, your outlined playbook is incredibly beneficial in steering customer relationships toward achieving these goals. Balancing usage and satisfaction could indeed transform how engaged they are in collaborating on positive business outcomes.

I genuinely find this playbook to be super helpful and actionable! Thank you for sharing such valuable insights.